Why Understanding Your Balance Sheet Is Imperative to Overall Financial Health

Posted on July 1, 2025 by Oozle Media

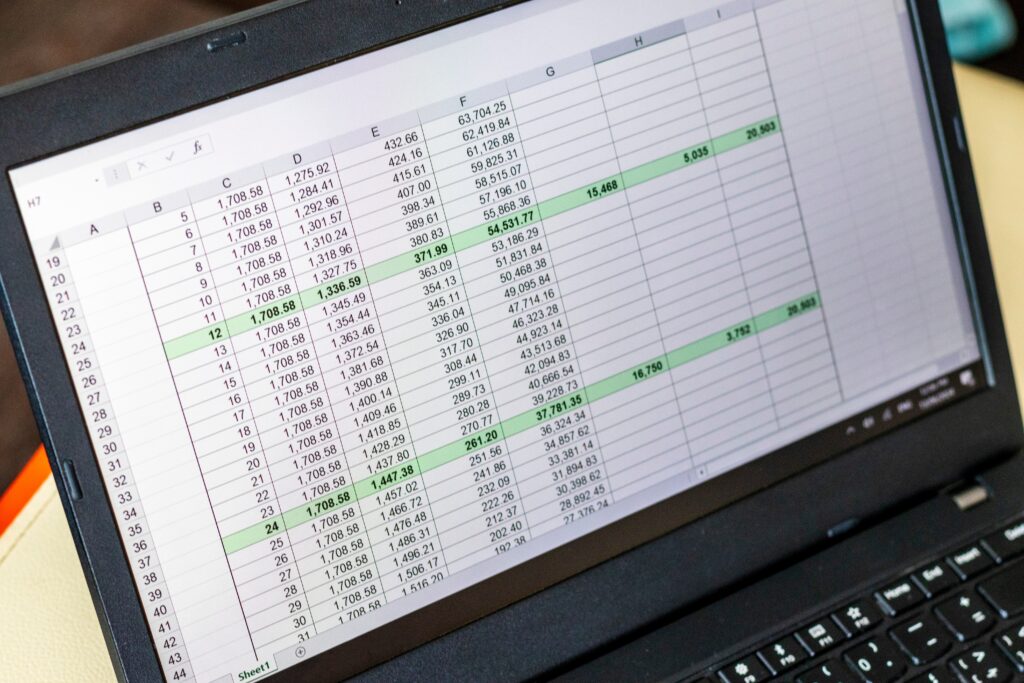

When most business owners think about their finances, they go straight to the profit and loss (P&L) statement. While tracking income and expenses is important, there’s another financial report that often gets overlooked—but is just as critical: the balance sheet.

At LSA CPA, we believe understanding your balance sheet is non-negotiable when it comes to evaluating the true health of your business. Here’s why:

It Shows What You Own vs. What You Owe

Your balance sheet is a snapshot of your business’s financial position at a specific moment in time. It tells you how much your business owns (assets), how much it owes (liabilities), and what’s left over (equity). That simple equation—Assets = Liabilities + Equity—is the foundation of your financial health.

You may be profitable, but if your liabilities are growing faster than your assets, your business could be headed for trouble. The balance sheet exposes these warning signs before they become crises.

It Reflects Stability and Long-Term Strength

The P&L shows short-term performance. The balance sheet shows long-term sustainability. Is your business building equity year after year? Are you too leveraged with debt? Do you have enough working capital to survive a slow season? These are balance sheet questions—and they matter just as much as this month’s revenue.

Lenders and Investors Care About It

If you’re applying for financing or courting investors, you can count on one thing: they’ll be looking at your balance sheet. Why? Because it reveals your business’s capacity to handle debt, manage assets, and maintain solvency. If you can’t speak confidently about your balance sheet, it can raise red flags—even if your P&L looks strong.

It Helps You Make Smarter Decisions

From buying equipment to expanding locations, major decisions should always be informed by your balance sheet. Do you have enough liquidity? Are your assets properly balanced? Will this investment strain your liabilities? Understanding the ripple effect of your choices starts with knowing where you stand financially.

It Completes the Picture

The P&L tells you if you’re making money. The balance sheet tells you if you’re building wealth. Ignoring one is like reading only half a book—you might get part of the story, but you’re missing the big picture.

At LSA CPA, we help business owners go beyond the basics and truly understand how to use their financial reports—including the balance sheet—as a tool for growth, security, and smarter strategy.

Let us help you bring your financial picture into full focus.

Categories: Business

Leave a Reply